The festive fever is slowly wearing off, and the reality of the new year is kicking in.

Most people use this time to complete setting up their vision boards or to set a realistic approach to how they can best achieve their goals in the new year.

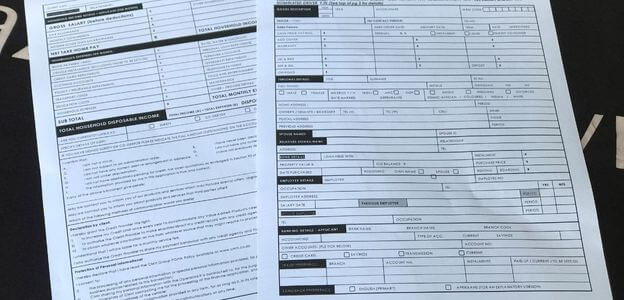

If getting a new car, whether new or pre-owned, is a box you are planning on ticking this year, then we want to simplify the buying process. Applying for vehicle finance is not that complicated, as you only need to know the prerequisites.

With the current state of the economy, the reality is that not everybody can afford to purchase a vehicle in cash. Nonetheless, that should not discourage you because we work with various banks to ensure that we can assist you with getting into your next dream car through our simple and instantaneous finance process.

So, what do you need:

VALID SOUTH AFRICAN IDENTITY DOCUMENT

You will need a valid copy of your Identity Document / Passport.

MINIMUM NET SALARY OF R6500

You must be a paid employee with a minimum monthly net income of at least R6500, an obligatory requirement for qualifying for vehicle finance with most major banks.

PROOF OF INCOME

You will need to provide the bank with three months’ payslips and six months’ bank statements for self-employed customers.

Subsequently, our Financial and Insurance Manager (F&I) will assess your affordability once the documents are verified.

PROOF OF ADDRESS

You will need to provide valid proof of residence (not older than three months) in the form of a municipality letter, utility bill or any document that reflects your details and current address. Alternatively, you can use a copy of your rental or lease agreement.

VALID DRIVERS LICENCE

Financial institutions require customers to have insurance in any vehicle purchased through vehicle finance for the entire financing period.

The cover guarantees they will get their money back, assuming anything happens to the vehicle.

Our F&I will always try to the best of his ability to assist you with the finance you need to purchase your vehicle. It is vital to listen to your F&I as they advise you on the best options to consider in terms of monthly repayments, interest rates, finance term length, balloon payments and even deposits.

Disclaimer: This information cannot be used as an official financial enquiry or advice. For official advice contact our FNI. Email: fni52@cmh.co.za Tel: 01 236 99800

For all your Mazda Queries, call us at 087 724 8464 or visit us at CMH Mazda Menlyn, 533 Celeste St, Menlyn, Pretoria, 0010.